Oil and gas companies like to be seen as responsible ‘corporate citizens’ that contribute to the societies they operate in. They present themselves as neutral providers of energy that create jobs and boost economic activity.

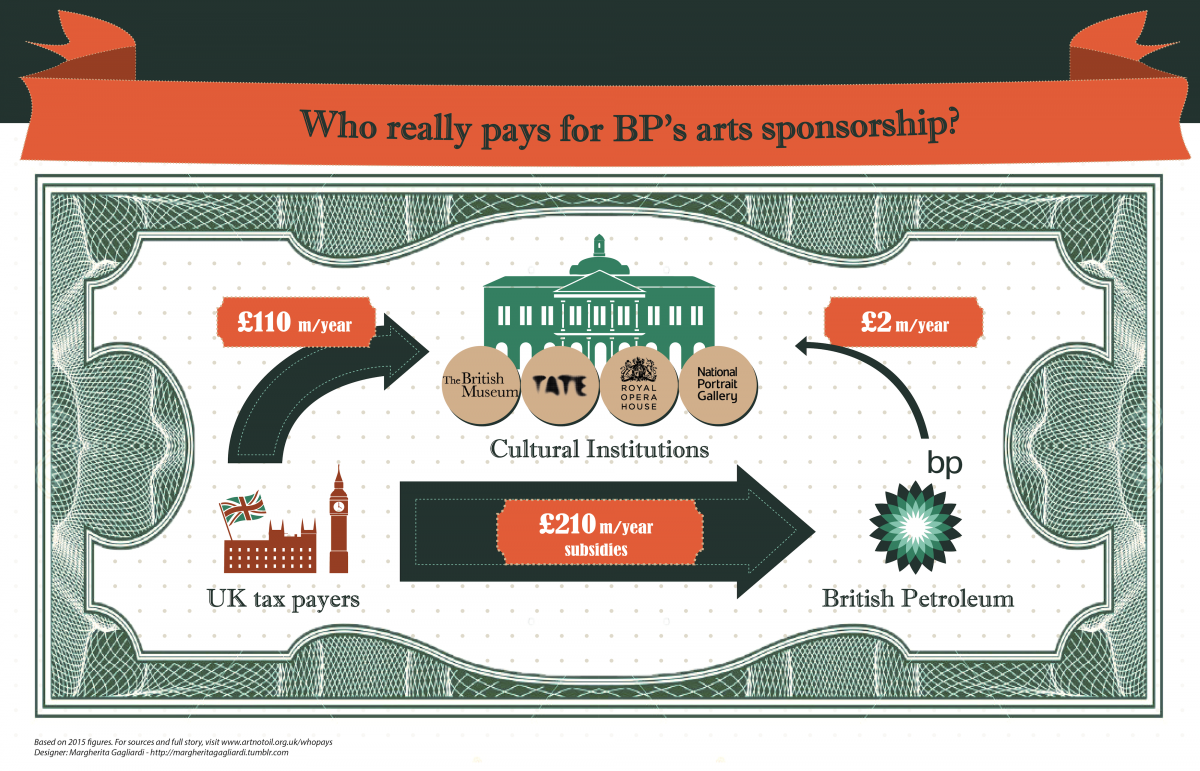

But many oil companies find underhand ways to avoid paying their fair share of tax, by using offshore accounts or creative accounting. Meanwhile, they take full advantage of generous handouts from governments while continuing to pay their CEOs million-dollar bonuses.

The oil business is notoriously corrupt. There have been many proven cases of oil companies caught offering bribes, and mysterious payments changing hands.

In 2018 BP made £5.6 billion in profits but paid no tax in the UK – instead, it received £133 million in tax credits from the public purse.

Senior executives at Shell knowingly took part in a vast bribery scheme that robbed the Nigerian people of $1.1billion. Now, the company and its staff are on trial in what is perhaps the biggest corruption case the oil industry has ever seen.

Unlike its competitors, Statoil/Equinor has managed to sustain a cleaner, more responsible image. In fact, the company has been found guilty of bribery and is often under scrutiny for its business dealings.

Thanks to its Swiss subsidiaries and its use of tax havens, Shell managed to pay no corporation tax in the UK in 2014, despite making a global profit of £19.87 billion. In 2016, the oil company did even better – it received a £112 million tax rebate from the UK government, again despite making billions in global profits.